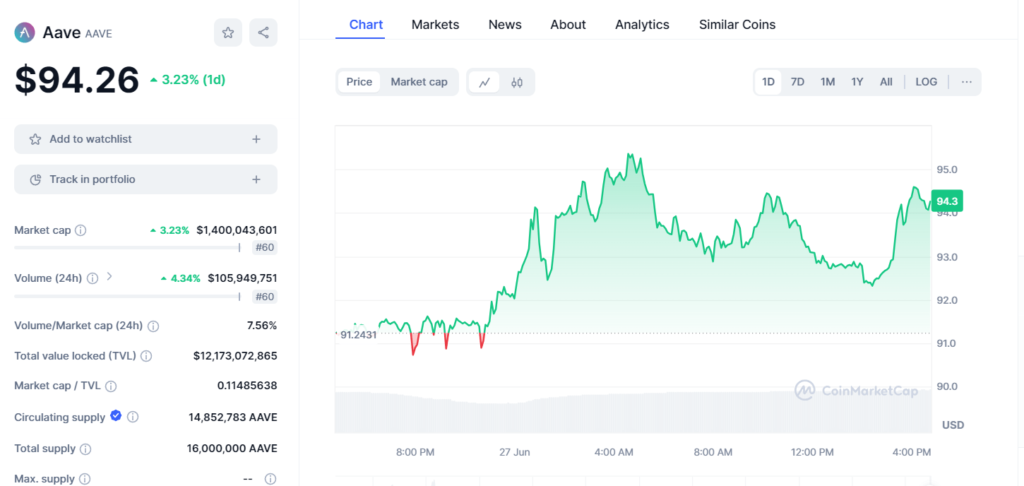

Aave, a leading player in the decentralized finance (DeFi) sector, has recently seen an encouraging increase in its market performance. With a price rise of 3.23% in a single day, bringing the value of AAVE to $94.26, the platform continues to attract attention and investment from the crypto community. This uptick is not just a daily fluctuation but a reflection of the growing trust and utility that Aave offers in the rapidly expanding world of DeFi.

Aave’s market capitalization has also increased by 3.23%, reaching $1,400,021,063, which solidifies its position as the 60th largest cryptocurrency. This increase in market cap is significant as it demonstrates the market’s recognition of Aave’s potential to revolutionize lending and borrowing practices within the blockchain ecosystem.

The trading volume for Aave over the past 24 hours was $105,747,826, which shows a robust activity level that matches its market cap position, both ranking at 60. A volume-to-market cap ratio of 7.56% indicates healthy liquidity, making it easier for investors to engage in trading activities without significant price impacts. This level of liquidity is crucial for both retail and institutional investors looking for stability and reliability in their investment choices.

One of the most crucial aspects of Aave’s ecosystem is its Total Value Locked (TVL), which stands at a staggering $12,173,072,865. The TVL is an essential metric in the DeFi space as it reflects the total amount of capital that is currently secured by the network through its lending and other financial services. Aave’s market cap to TVL ratio of 0.11485638 suggests that the market valuation is modest compared to the total value it holds, indicating potential room for growth or undervaluation relative to its actual usage and utility.

Aave’s tokenomics reveal a circulating supply of 14,852,783 AAVE out of a total supply of 16,000,000 AAVE, showing that most of its tokens are already in circulation. This limited supply is crucial as it helps prevent inflationary pressures and maintains token value, which is beneficial for long-term investors.

The recent performance of Aave can be attributed to several factors. As a protocol that enables users to lend and borrow cryptocurrencies, Aave has benefited from the increased demand for DeFi solutions that offer alternatives to traditional financial systems. This demand is driven by the wider adoption of cryptocurrencies and the increasing interest in platforms that provide passive income opportunities through mechanisms like yield farming and liquidity mining.

Moreover, Aave has been at the forefront of innovation within the DeFi sector, consistently introducing features that enhance user experience and security. These include the introduction of governance features that allow token holders to vote on key protocol decisions and updates to its smart contracts that improve transaction efficiency and security.

For investors, Aave presents a compelling opportunity to participate in the DeFi space, which is known for its high returns but also comes with its set of risks, primarily stemming from market volatility and regulatory uncertainty. However, Aave’s established position and ongoing commitment to innovation and user safety make it a standout among many DeFi platforms.

In conclusion, Aave’s recent uptick in price and market cap is a testament to its enduring relevance and growing influence in the DeFi sector. As it continues to evolve and expand its offerings, Aave remains a significant player in the landscape of decentralized financial services, promising new opportunities for growth and investment.

+ There are no comments

Add yours