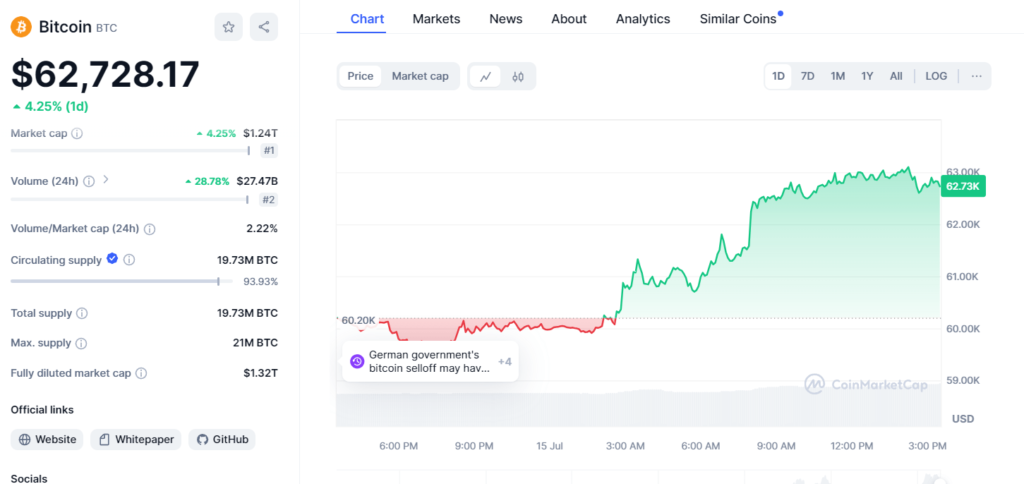

Bitcoin (BTC) continues to dominate the cryptocurrency market with a current price of $62,743.13, marking a 4.22% increase over the last 24 hours.

This surge underscores Bitcoin’s resilient position as the leading digital asset by market capitalization, which stands at approximately $1.24 trillion, capturing 4.25% of the total cryptocurrency market.

In terms of trading volume, Bitcoin shows significant activity, recording $27.47 billion in the last 24 hours, representing a 28.82% share of the total market volume.

This high trading volume reflects robust investor interest and trading activity in Bitcoin, highlighting its liquidity and widespread adoption among traders and investors globally.

Bitcoin’s circulating supply currently stands at 19.73 million BTC, which represents 93.93% of its total supply. The maximum supply of Bitcoin is capped at 21 million BTC, a feature that contributes to its appeal as a deflationary asset and a hedge against inflationary pressures that affect fiat currencies.

When considering the fully diluted market capitalization, which accounts for the total supply of Bitcoin at its maximum limit, the figure stands at approximately $1.32 trillion.

This metric provides a theoretical upper bound on Bitcoin’s market value, factoring in all coins that could potentially be in circulation if every Bitcoin were mined and made available.

Bitcoin’s market dynamics reflect its status not only as a financial asset but also as a store of value and a digital currency with widespread adoption.

Its decentralized nature and finite supply have contributed to its reputation as “digital gold,” a comparison that underscores its potential to serve as a long-term store of wealth and value preservation tool.

The recent price increase of Bitcoin aligns with broader trends in the cryptocurrency market, where institutional adoption, regulatory developments, and macroeconomic factors influence investor sentiment and market movements.

As Bitcoin continues to evolve, its role in global finance and investment portfolios is likely to expand, driven by technological advancements and growing acceptance among traditional financial institutions and retail investors alike.

Overall, Bitcoin’s current market data underscores its resilience, liquidity, and dominance within the cryptocurrency ecosystem. With ongoing developments in blockchain technology and increasing institutional adoption, Bitcoin remains a pivotal asset in shaping the future of digital finance and global economic systems.

In conclusion, Bitcoin’s recent performance highlights its enduring appeal as a leading digital asset, underpinned by strong market fundamentals, growing adoption, and its distinctive characteristics as a decentralized, deflationary currency.

As the cryptocurrency landscape evolves, Bitcoin stands poised to maintain its position as a cornerstone of digital finance and a key player in the global monetary system.