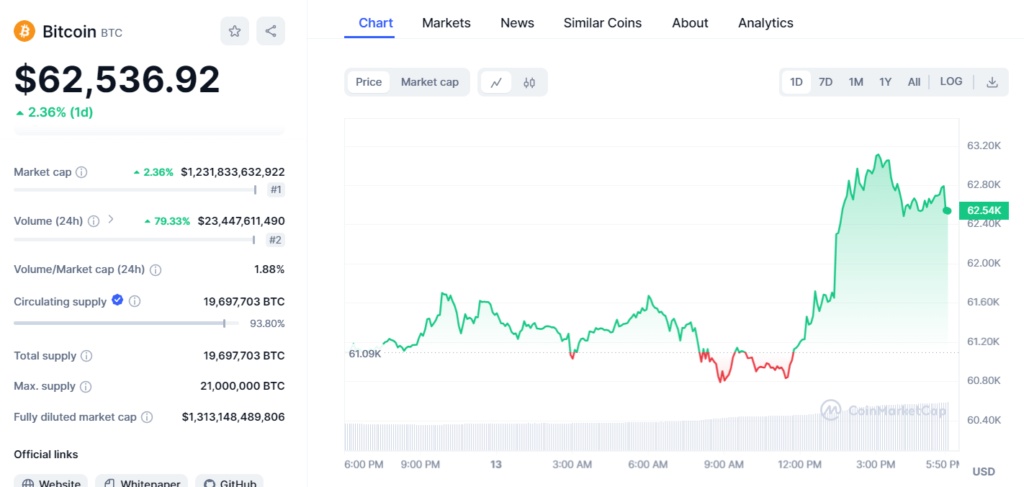

Know that the best thing about standing and not falling is not standing alone but reaching a new world by the bridge as the recent two days with a 2% rise in the price of the cryptocurrency individualized the Bitcoin price. Quite often, the appraiser determines only about 35% of the house price that is presented in the certificate, for example, the last one, the appraised price of the house is considered to be $90,895 against $62,536 that it should be. 92. The only thing that keeps investors confident as well as keen on Bitcoin as a digital coin and a hedge against the fluctuations of regular assets is the story of Bitcoin. With the completion of this period, its name as a rover of markets has been written, with the capitalization of the market reaching its desired level of $1 m. In its time, the economy had been $203. Currently a leader in the crypt convertible market with $12 billion, no crypto can be called the leader of all cryptos.

In the last 24 hours, the number of transactions has increased to 79. 33%, totaling around $23. 448 billion. On the other hand, the observed situation can also contribute to the high sensitivity of instruments to price fluctuations. The reason behind such a big shift in their trading positions might be the reaction they are reacting to some kind of news or some other such external factor that is influencing them.

The supply-and-demand model of the value of this bitcoin-marketed has now become a reality for you if you like it and they only have zero on it now. 1. Liquidity measured by a traded volume is 88% shows that it makes the statement about liquidity extremely powerful. The completely unnecessary liquidity reserve particularly opens the opportunity for those who sow their oats in Bitcoin to do so by buying or selling without any remarks of rising or falling price and such a situation that hypothetically could cause anxiety and panic in the investment community. It is of course the percentage of Bitcoins, which is being traded as the most liquid currency on the forex platforms.

Nevertheless, the money valuation is complex and these numbers surprise much because the maximum supply of Bitcoin is estimated only to be approximately 19 million on floating supply. The amount of BTC used in transactions is of course incredible, with estimates are at about 698 BTC by now. In this, it is not the 93% of anything that has ever existed on Earth. The first 8 million Bitcoins out of the proposed total stock of 21 million BTC, which is estimated to be released by the end of mining, must be attributed to either of the two groups: harvesters and the firm personnel on the one hand and ardent supporters of BTC idea on the other hand. These users usually are those who can own the possibility of coin usage for buying, which is the main excess of this crypto coin. At last, this factor made coin value high because, according to the laws of supply and demand, which can be very well known to all market players, more coin means higher price.

The existing market capitalization as well as the one which takes into account the total assets held in the fixed number of Bitcoin, namely the circulating and all noncirculating ones, stands at around $1 in the dollar. 313 trillion. For this metric to be your yardstick that could assist you in showing if the particular crypto is doing well in the market or needs some more work, it will require you to focus on the upper limit of this crypto, at the point where it can trade at the higher price provided if the trend for the current market price will go on.

The crypto market price for Bitcoin of today reflects its typical volatility which is the reality for all digital currency products, but it equally reveals a regular pattern of an uptrend that has emerged mostly in the last few months. This penchant can be substantiated for the following reasons: the growth of stable institutions dominates over the paradigm shift of Bitcoin which is an alternative to gold, and the spread of the crypto networks across many countries.

In the distance, we spot the peak of the altcoin, which resists the fight of everyone and everything, including the old money and stock market. Not only the price change is a signal of the market trend but also it could indicate the extent of investor’s confidence and the economic performance of the country.

To sum up, we can conclude that the price of Bitcoin is like a sensor or watchdog for the cryptocurrency market by association and may actually be the pioneer for the industry as a whole. It is no surprise that this entrepreneur is capable of meeting the disparities and the unpredictable flow of the whole market. Thus, however, the manufacturers know that it is that specific position that eventually affects the brand name in the market. The investors, both the newcomers and the veterans, are so excited to check the movements of Bitcoin as they can act as indicators of the overall market trends and the possible changes in the digital economy. So there are two questions crucial to the cryptocurrency markets: scarcity and demand. These questions lie in wait as Bitcoin mined approaches the maximum supply limit.