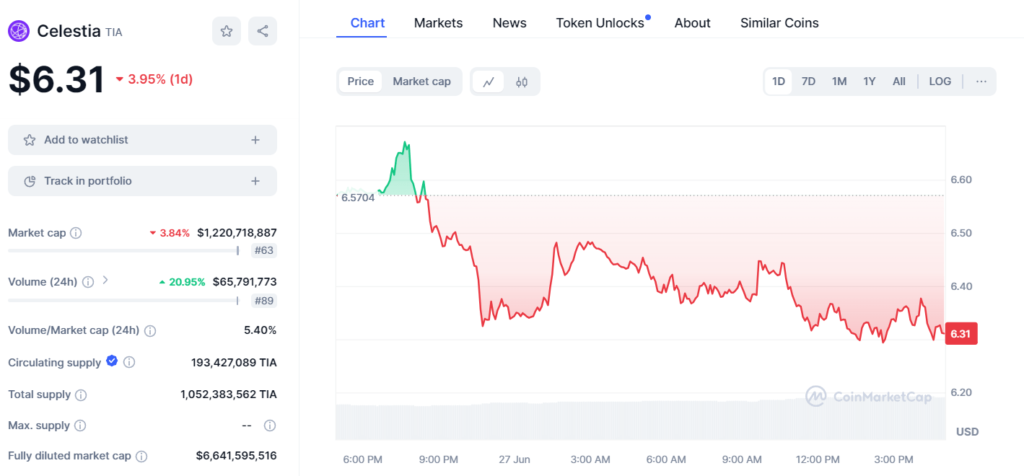

Celestia, identified by its ticker TIA, has recently experienced a notable market fluctuation. With a slight downturn of 3.95% in its day-to-day trading, the price per TIA token now stands at $6.31. This movement reflects a broader trend of volatility within the cryptocurrency sector, particularly for platforms like Celestia that are carving out new niches in blockchain technology.

Despite the day’s decrease, Celestia’s market capitalization remains substantial at $1,220,718,887, ranking it as the 63rd largest cryptocurrency. This is indicative of significant investor confidence in its long-term potential, even amidst daily price fluctuations. The platform’s innovative approach to modular scalability in blockchain networks is a key factor driving this interest.

The trading volume for Celestia has seen a remarkable increase of 20.95%, reaching $65,791,773 within the past 24 hours. This volume indicates robust trading activity and aligns with a volume-to-market cap ratio of 5.40%. Such a high ratio suggests that a significant portion of Celestia’s market cap is being traded on a daily basis, which can be a double-edged sword: it points to high liquidity (a positive for traders looking for exit or entry points) but also underscores the current volatility.

Looking at the supply details, Celestia has a circulating supply of 193,427,089 TIA, which is a small fraction of its total supply of 1,052,383,562 TIA. The full potential market impact of these additional tokens could lead to future price changes, particularly as they begin to enter the market. However, with no defined maximum supply, the long-term inflationary impact remains a point of consideration for potential investors.

The fully diluted market cap of Celestia, assuming all tokens were in circulation at the current price, would stand at an impressive $6,641,595,516. This hypothetical value provides a glimpse into the full economic scale of Celestia under total dilution, offering investors and analysts a benchmark for its future valuation potential.

Celestia’s market position and the recent fluctuations can be attributed to several factors. As a project, Celestia offers a unique “modular blockchain” approach, which aims to decouple consensus from data availability, thereby enhancing scalability and efficiency. This technological innovation is highly regarded in the blockchain community, especially as scalability remains a critical bottleneck for mainstream blockchain adoption.

However, like all cryptocurrencies, Celestia’s market movements are subject to broader economic conditions, regulatory changes, and shifts in investor sentiment. The recent dip could be tied to market-wide corrections, shifts in technology stock performances, or speculative trading patterns commonly seen in crypto markets.

For investors, Celestia presents an intriguing opportunity. Its technology has the potential to significantly impact how future blockchains are designed and operated, potentially offering high returns. However, the investment comes with risks associated with the volatile nature of the cryptocurrency markets.

In conclusion, while Celestia has faced a slight downturn in its latest trading cycle, the platform’s innovative approach and solid market capitalization reflect a promising future. As investors and users continue to navigate the complexities of the blockchain space, Celestia remains a noteworthy project for its potential to redefine scalability and efficiency in the industry.