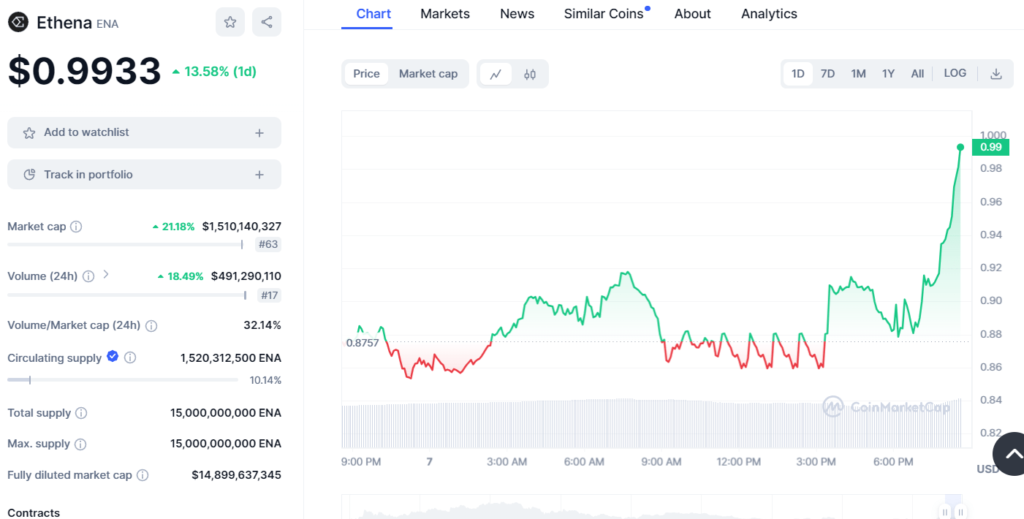

The highest point where the price of the cryptocurrency Ethena (ENA) increased was $0. 9933 which happened to be a great 13. 58% rise within 24 hours. The recent spike in the price of ENA has brought the attention of market watchers and traders to this liquid asset and, consequently, validated its volatile nature and market dependence. The morning started with the coin at 0 dollars. It gyrated wildly at its highest level before settling a bit under one dollar.

Ethena’s capitalization grew by 21 percent. 18%, reaching approximately $1. Of 56. 51 billion. This places the company at sixty-third in the global market rankings. The 24-hour trading volume has gone up by 18 percent. 49% of which equals almost $491 million, therefore, it reflected increased trading activity and investor’s focus.

Despite all of these alterations, however, the cryptocurrency market is still under regulatory observation. Similar to Bitcoin, Ethena will be affected by the permanent alterations of the regulations with digital assets being divided into commodities and securities.

Despite the upcoming probably storm of regulation, Ethena stays resilient as one of her peers in the cryptos. They will bounce back as investors find alternatives to normal financial securities during economic distress.

The ENA/USD technical chart depicts that after a sluggish rise from $0,enny will trade within a sideways range, mostly between $0. What would probably be Enny´s path in the next few days or so? 857, with the peak of Ethena at $0. 9. Such price fluctuations implied an ascending triangle that meant a potential new increase, especially after the price surpasses the psychological number of one dollar.

But the first resistance level that should be considered is $0. Option 995 is a loose character of the key $1. Breaking over the $0. At the $1 level, ENA will take a new high and most likely, the resistance level at 85. 02 and $1. 05. On the other hand, the $0. 95 remains solid. If the price goes down, the market will retest the lower support at $0. 92.

The technical indicators are too vague in their prejudice. After the MACD line moves up and over the signal line, the bullish crossover of the Moving Average Convergence Divergence (MACD) takes place showing more bullish momentum. On the other hand, when Stochastic RSI is close to overbought, it implies that the price would have a consolidation or a small pullback in the short term before making higher highs.

To sum up, Ethena depicted a high level of persistence in the extremely volatile market and even the technical indicators give some little rays of hope for the near future. Ethena is expected to be significantly influenced by regulatory changes and market movements in the coming days that are well monitored by traders and investors.