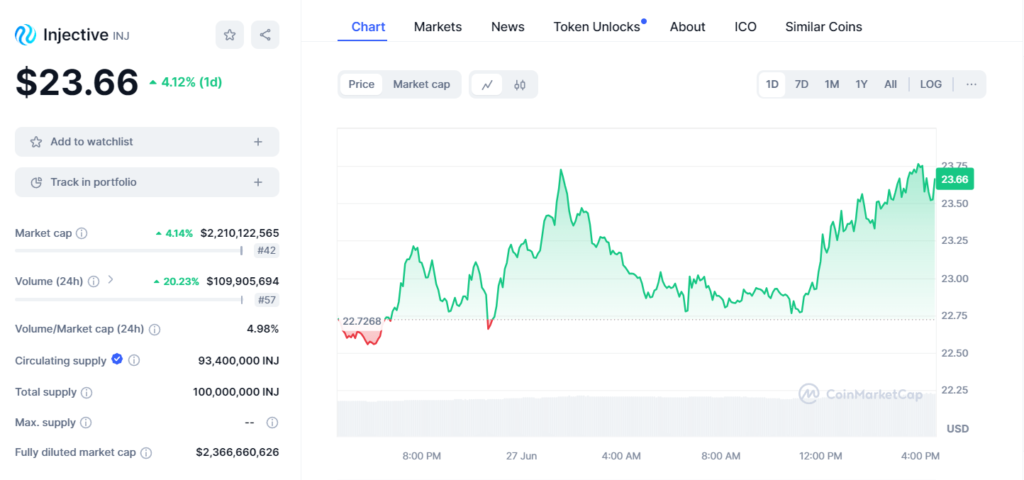

Injective Protocol, represented by its token INJ, has been capturing the attention of the decentralized finance (DeFi) community with a notable increase of 4.13% in its price, currently standing at $23.67. This uptick is reflective of a broader trend where investors are increasingly turning towards platforms that offer innovative financial solutions in a decentralized setup.

With a market capitalization that has risen by 4.07% to reach $2,210,441,315, Injective Protocol now ranks as the 42nd largest cryptocurrency. This progression is indicative of growing investor trust and the protocol’s increasing relevance in the DeFi sector, where it aims to revolutionize how financial markets operate by ensuring full decentralization and borderless access.

Injective’s trading volume over the past 24 hours was $109,504,074, marking a substantial increase of 20.07%. This positions it 57th in terms of cryptocurrency trading volumes. The volume-to-market cap ratio stands at an impressive 4.98%, signaling healthy liquidity that facilitates ease of trading, an essential factor for attracting continuous investment into the ecosystem.

Focusing on the supply metrics, Injective has a circulating supply of 93,400,000 INJ, which is a substantial majority of its total supply capped at 100,000,000 INJ. The closeness of these two figures suggests that most of the tokens intended for circulation are already in the market, providing clarity on the supply front. This near completion of token distribution contributes to price stability since the impact of new tokens entering the market is minimized.

The fully diluted market cap, which considers that all tokens are issued and circulating at the current price, is estimated at $2,353,185,944. This metric is crucial as it provides a snapshot of the potential market value of the protocol under fully realized conditions, offering investors a perspective on growth potential and valuation at maturity.

Injective Protocol’s recent performance can largely be attributed to its unique offerings in the DeFi space. The protocol allows for fully decentralized trading without any intermediaries, supporting a wide range of derivatives, including futures and perpetual swaps. This capability is highly appealing in a financial landscape that is increasingly leaning towards automation and disintermediation.

Moreover, the recent growth can also be linked to the overall bullish sentiment in the crypto market, especially around platforms that provide DeFi solutions. As traditional financial institutions continue to show interest in blockchain technologies, platforms like Injective that offer clear benefits in terms of transaction speed, cost, and access barriers are likely to benefit.

For investors and crypto enthusiasts, Injective Protocol presents a compelling case. Its innovative approach to decentralizing financial markets not only offers immediate trading benefits but also aligns with broader trends towards financial sovereignty and market efficiency. However, potential investors should remain cautious and consider market volatility and regulatory changes as these factors could affect the protocol’s adoption and token value.

In conclusion, Injective Protocol’s recent surge in market activity and investor interest reflects its significant potential and growing footprint in the DeFi sector. As it continues to develop and expand its offerings, Injective stands out as a key player in the future landscape of decentralized financial services.