Sei is the native token to SeiNetwork, an open-source… and highly scalable Layer 1 blockchain built on the Cosmos SDK, a structure that facilitates the development of decentralized financial applications. The system intends to create a notion-based protocol that offers disintermediated characteristics for exchanges, market-making, lending, derivatives, and others alike.

“The meteoric rise of Sei’s token price suggests more and more investors are now persuaded that the Cosmos ecosystem might realize the scalability and sustainability challenge which had escaped its previous blockchain generations,” said Linda Xie, MD at Castle Island Ventures, an investment firm in crypto assets. This alongside Sei’s low-transaction-fee nature, high throughput, and native interoperability which were problematic in comparable DeFi blockchains make Sei a popular option.

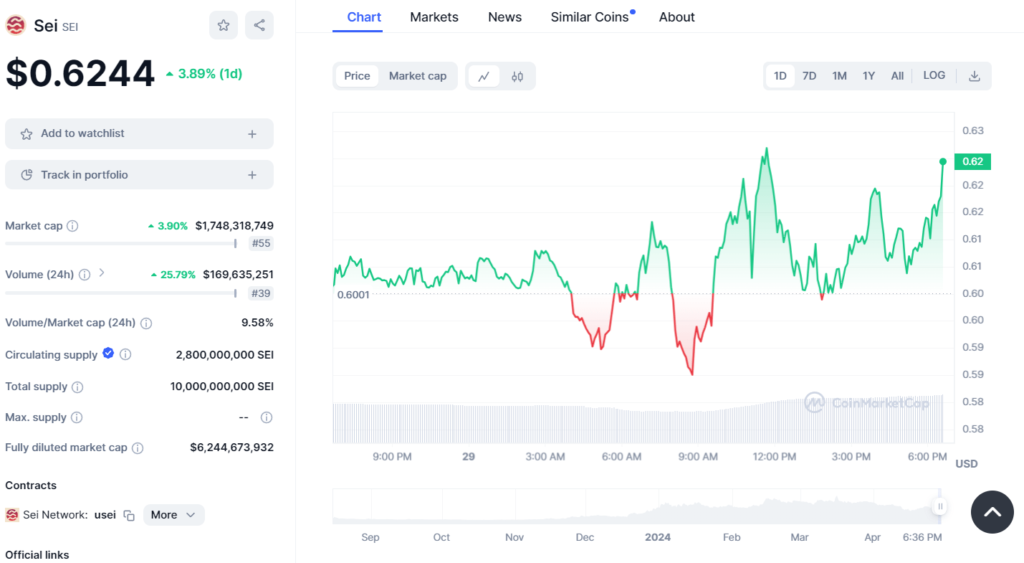

Having a circulating supply of $2.8 billion tokens and with a current price tag of $0.6251 Sei Crypto’s market capitalization is around $1.75 billion, meaning that Sei Crypto currently ranks 55th among cryptocurrencies by that metric. Although this token is still on a low market cap of $1.7 million, a huge volume of trade records has reached over $168 million in the past 24 hours with 9.58 percent of the token’s volume-to-market cap ratio.

Sei has just achieved its new price growth in the recent development of its key ecosystem which are several ecologic development milestones. In March, the network’s own Dex dubbed Sei Decentralized Exchange (DEx) was launched. DEx is an order book-based exchange with state-of-the-art connectivity known for its lightning-fast trading issues and minimal slippage. Sei DEx took over $150 million in cumulative trading volume is a truly impressive feat made since it has been fully live for one month.

Additionally, two-week-since-the-launch of its liquid staking platform Polysei, the Sei has up to $300 million in total value locked as users flood in to stake their SEI tokens and earn yield without worrying about lock-in periods.

“Sie has been really impressed with the speed at which the Sei ecosystem has grown and has been able to deliver key infrastructure components like its own DEX, and liquid staking,” said Ayan Bhattacharya, a Sei investor and cryptocurrency user. “The tech addresses many of the scaling and composability problems that have caused pain in DeFi on Ethereum and other legacy chains. To make mathematic computations, different amounts of SEI, Ethereum, or SEI stored in a bank provide access to varying rewards. It sounds like reproducing a fixed percentage for the assets involved that are controlled by the processor in order to create products. This is what is also being

Part of Sei’s recent spur-up is the very fact that it put much effort lately into building up the environment necessary for the appearance of fully decentralized market makers and fee-takers. The Sei-developed Diffuse Market Maker (DMM) framework together with the platform’s extremely low microtransaction fees for transactions measured in millionths of a penny has attracted a lot of trading firms and funds to analyze the possibility of using namely Sei for the implementation of such a strategy.

“Sei just began to realize the real products in terms of onboarding IGL liquidity to our ecosystem,” said Xie. “Boasting a distinct approach specializing in DeFi market-making, we consider Sei a Cosmos project that benefits other endeavors and a crucial player for the massive introduction of global capital to the decentralized trading and exchange sectors.”

For now, these are just forecasts, but some analysts envisage Sei Network to eventually handle the trillion-dollar trade volume through its DeFi (Decentralized Finance) ecosystem’s attractiveness as more market makers, funds, and DeFi users migrate to it. Conversely, if the continuing surging of demand becomes the case, the SEI token obviously has the potential to go higher.

With the speed and depth of the Cosmos ecosystem growing day by day and becoming the vital DeFi infrastructure for different real-world use cases, the Sei projects, manifesting to harness the powerful scalability and interoperability of the Cosmos are those worthy of attention. Even for investors who are extremely cautious and are seeking to take part in the innovation cycle of the next DeFi, the SEI token may prove wise to be on their radar.