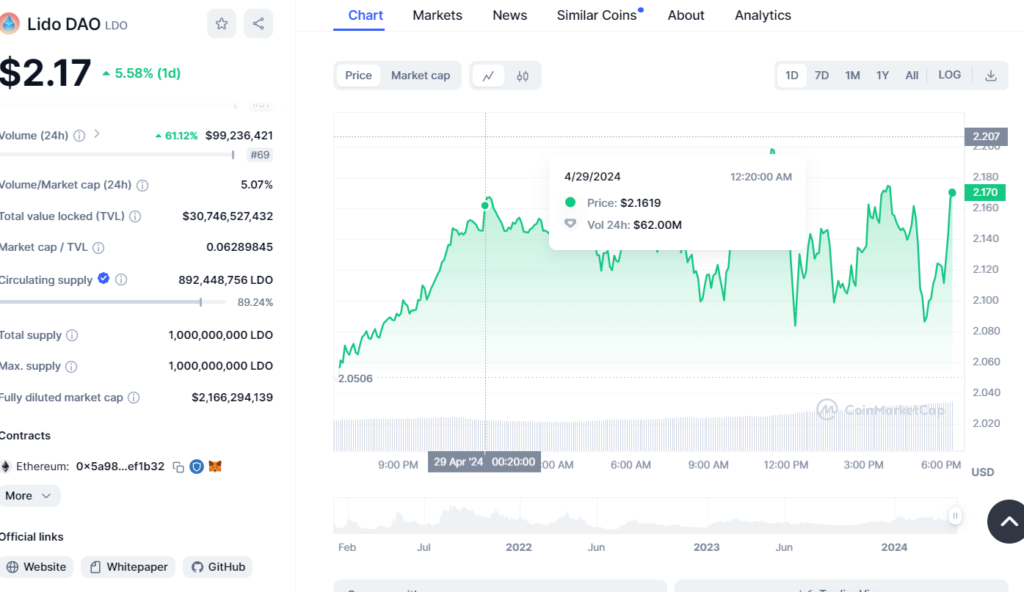

The price of Lido DAO (LDO) token has gone up by over 5.6% in the last 24 hours to reach $2.17 with investors rushing to get their hands on whold staking sector which is rapidly growing. The rally was the main reason for Lido’s market capitalization to reach $1.9 billion and remain among the top 50 cryptocurrencies.

Lido is a decentralized liquid staking protocol that provides liquidity to the users, even if the users have staked their tokens such as Ethereum. Instead of locking up their holdings until validator withdrawals start, Lido presents stakers with a liquid derivative token that they can transfer to DeFi or exchange on platforms.

“The achievements of Lido DAO confirm the rising institutional appetite for liquid staking services hence the growing popularity of proof-of-stake blockchains, such as Ethereum,” said Yin Jiang, Director of Research at Stakefish Capital. “Staking is a multi-billion dollar market now but most stakeholders do not want to give up liquidity. Lido’s solution neatly resolves the problem.”

As of now, Lido has an overwhelming $30.7 TVL in its liquid staking pools for different Ethereum assets, including Polygon, Kusama, and Polkadot. This TVL figure is greater than 30% of the total $97 billion in assets now being staked via various liquid staking protocols.

Lido’s dominance in the liquid staking sector has been largely due to its concentration on decentralization, with main operations being done through the LDO token and a distributed group of node operators. This goes against the more decentralized liquid staking competitors such as Rocket Pool and Stkr.

Raj Gupta says, “I have been using Lido before Ethereum merge for staking ETH yet having liquidity to be a part of DeFi.” This is the statement of crypto investor who also happens to be a Lido user. This shows the increasing popularity of liquid staking towards Ethereum withdrawals, and even more reasons for me to buy Lido’s token.

Currently, Lido price is $2.17 which makes its market capitalization near $1.93bn given its 892 million LDO circulating supply. But the fully diluted market cap could rise to $2.17 billion upon reaching its total token supply of 1 billion.

Specifically, Lido’s current market cap to TVL ratio is only 0.063, indicating that the token might be under-priced for the impressive amount of the total value it provides through staking services.

“The story of the staking liquidity is still in its early stages, and Lido has already become a clear leader with a good record of security and governance that’s distributed,” said Jiang. “With increasing adoption and investors having more trust channeling their funds in staking derivatives, multiple fold increase of the LDO token is possible.”

The token’s rise continues unchecked with a promise of multiple new integrations and supported assets on the way. If the development of Ethereum’s roadmap remains on track, with staking withdrawal expected around 2024, demand for accessible staking across Lido’s liquid platforms could be even higher due to this.

Investors attracted by the liquid staking megatrend will find in Lido DAO the first decentralized solution and their most trustworthy token: Lido DAO is a credible token within the crypto sector. Given that blockchain staking becomes more popular, projects like Lido will surely be behind it all.