The cryptocurrency market is a rollercoaster of emotions, and this Sunday is no exception. While some coins like Mog Coin experienced meteoric rises, others, like Monero (XMR), found themselves facing a not-so-sunny Monday.

Despite being a well-established player, Monero landed on CoinMarketCap’s “top losers” list, leaving some investors scratching their heads. Let’s delve into the reasons behind Monero’s recent dip and analyze its performance over the past 24 hours and the past week.

Monero is a household name in the crypto world, known for its focus on privacy and anonymity. Unlike Bitcoin, where all transactions are publicly viewable, Monero utilizes sophisticated cryptography to make transactions virtually untraceable. This focus on privacy has garnered a loyal following, particularly among users who value financial confidentiality.

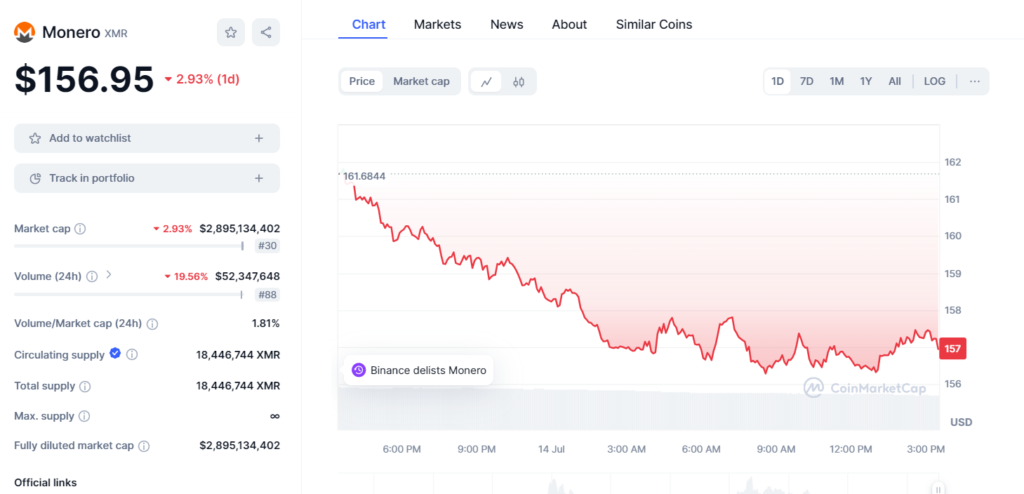

However, Monero’s recent price action tells a different story. As of Sunday, July 14th, Monero is trading around $156.99, reflecting a 2.30% decrease in the past 24 hours. While this might seem like a small drop, it represents a reversal of the positive momentum Monero had experienced earlier in the week.

To understand the bigger picture, let’s rewind a bit. Just a week ago, Monero was hovering around $140. News of a partnership with Axelar Foundation, aiming to improve communication between different blockchains, sent a wave of optimism through the Monero community. This positive development fueled a surge in Monero’s price, pushing it past $157 within a few days.

However, the good times didn’t last. On July 12th, a bombshell dropped. Ripple co-founder Chris Larsen, who holds a significant amount of XMR, revealed that his wallet had been hacked for an estimated $112 million.

This news sent shockwaves through the crypto market, casting a shadow over privacy-focused coins like Monero. Investors worried that the hack could potentially expose vulnerabilities in Monero’s technology, leading to a price decline.

So, is Monero’s recent dip a cause for concern? It’s difficult to say for certain. The 2.30% loss might be a temporary correction after a week of gains. However, the hack and the ongoing legal battle between Ripple and the US Securities and Exchange Commission (SEC) continue to cast a shadow of uncertainty over privacy-focused coins.

Looking ahead, Monero’s future remains somewhat unclear. The continued development of its core technology and its ability to address security concerns will be crucial factors in determining its long-term viability. The outcome of the Ripple vs. SEC case could also have a significant impact on the entire privacy coin sector.

Despite the recent dip, Monero’s loyal community and its established position in the privacy-focused crypto space shouldn’t be discounted. However, for potential investors, it’s important to be aware of the current challenges and conduct thorough research before making any investment decisions.

Monero’s story serves as a reminder that even established cryptocurrencies can experience unexpected setbacks. The crypto market is a dynamic and often unpredictable landscape. Investors should be prepared for both the ups and downs, and prioritize research and a long-term perspective when navigating this ever-evolving world.