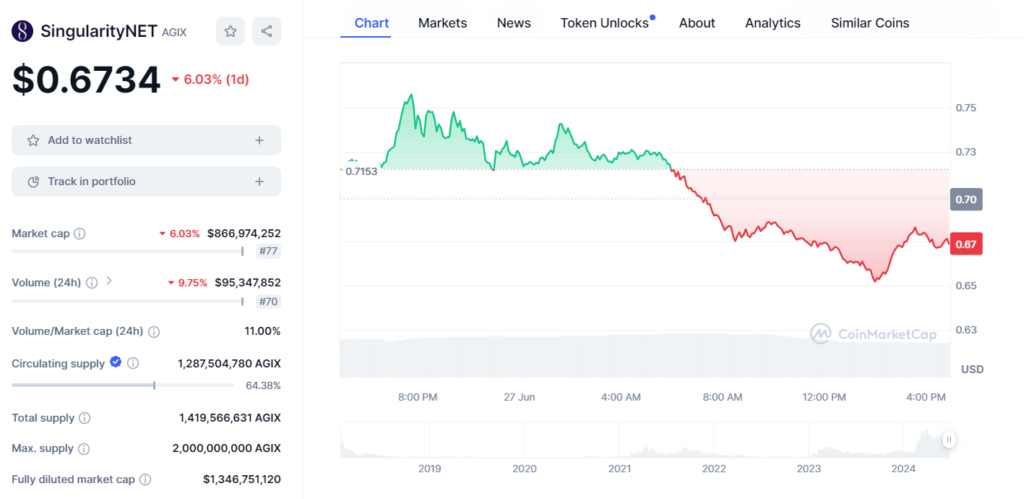

SingularityNET, marked by its token AGIX, has recently experienced a notable dip in its market value, decreasing by 6.03% in a single day to a price of $0.6734. This decline is part of a broader trend observed in the cryptocurrency’s performance, prompting both investors and analysts to take a closer look at its underlying factors and potential trajectory.

Currently, SingularityNET’s market capitalization stands at approximately $866,974,252, positioning it as the 77th largest cryptocurrency in terms of market cap. This reflects a significant drop, mirroring the decrease in token price. Despite this downturn, the platform continues to hold a pivotal role in the integration of blockchain technology with artificial intelligence, aiming to revolutionize how AI services are accessed and developed across various industries.

The trading volume for SingularityNET has also seen a change, with a decrease of 9.75% resulting in a volume of $95,347,852 over the last 24 hours. This reduction in volume, combined with the market cap’s decline, brings the volume-to-market cap ratio to 11.00%. High ratios typically indicate a higher liquidity which can attract traders looking for quick entries and exits, suggesting that despite its price decrease, the token remains active in trading circles.

SingularityNET’s supply metrics reveal a circulating supply of 1,287,504,780 AGIX, which is approximately 64.38% of its total supply of 1,419,566,631 AGIX. The maximum supply is capped at 2,000,000,000 AGIX, indicating that there is still a substantial amount of the token that could enter the market, potentially influencing its price further.

The fully diluted market cap, which assumes that all tokens are circulating at the current price, stands at $1,346,751,120. This figure provides investors with a broader perspective on the total value of the network under fully realized conditions and is essential for evaluating its growth potential against its current performance.

The recent market movements of SingularityNET can be attributed to several factors. Key among these is the volatile nature of the cryptocurrency market itself, which is influenced by broader economic conditions, shifts in investor sentiment, and changes in regulatory landscapes. Additionally, as SingularityNET continues to develop its decentralized marketplace for AI services, any updates or changes in its technological offerings or strategic partnerships can significantly impact its market performance.

For investors and enthusiasts in the blockchain and AI sectors, SingularityNET represents a unique blend of technology with vast potential. Its focus on creating a decentralized AI ecosystem where developers can create, share, and monetize AI services offers a transformative approach to how AI and machine learning tools are deployed and consumed.

However, as with any investment, especially in the high-stakes world of cryptocurrencies, potential risks stemming from market volatility, technological challenges, and competitive pressures must be carefully considered. Investors should keep a close eye on the platform’s technological advancements, market adoption rates, and community engagement, as these factors will play critical roles in shaping SingularityNET’s future trajectory.

In conclusion, despite recent downturns, SingularityNET remains at the forefront of a significant technological convergence between AI and blockchain. As it navigates through its current challenges, the platform’s innovative solutions continue to offer substantial promise for reshaping future technological landscapes.