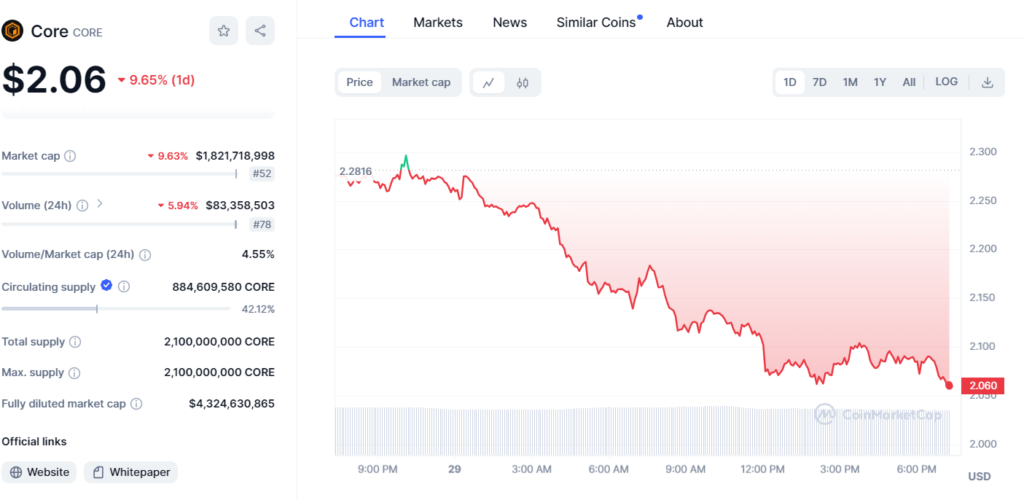

The price of Core DAO’s governance and utility token CORE has fallen dramatically over the past 24 hours, declining nearly 10% amid a broad selloff across cryptocurrency markets. As of this writing, CORE is trading at just $2.06, down from around $2.28 yesterday.

The double-digit price drop puts further pressure on CORE, which has struggled to regain its footing after hitting all-time highs above $5 last November. Year-to-date, the token is down a staggering 45% as cryptocurrency markets have been roiled by persistent macroeconomic pressures and a string of high-profile corporate failures and hacks.

“Cryptocurrency markets remain in disarray as lingering inflation fears and regulatory crackdowns have absolutely decimated sentiment,” said Quant Investment Strategies Head of Research Janice Shelton. “CORE has been hit especially hard due to its exposure to DeFi lending markets and perceived redundancy now that Ethereum’s core developers have committed to working on first-party staking services.”

Indeed, data from market data aggregator CoinGecko shows that the total value locked (TVL) across Core DAO’s suite of DeFi lending applications has fallen over 30% in the past three months to just $425 million. This dwindling TVL reflects flagging user demand and activity.

Core Coin, Period: 24h Price Chart

At a $1.82 billion market cap and circulating supply of 884 million tokens, CORE now ranks as just the 52nd largest cryptocurrency by valuation. This is a remarkable decline from its position in the top 20 just six months ago.

However, some remain confident that CORE can regain its luster given its unmatched capabilities and the growth potential of the Core DAO ecosystem.

“The core value propositions of unstoppable self-sovereign lending and democratized protocol governance haven’t changed,” asserted Core DAO co-founder and business lead Jin Rama. “We’re still extremely early in the evolution of DeFi, and I expect CORE’s utility and intrinsic value to become increasingly apparent as markets stabilize and our user growth resumes.”

Rama pointed to several key initiatives in the pipeline for Core DAO that could drive a resurgence for CORE, including the launch of a first-of-its-kind decentralized reserve currency protocol and the Core Passport Web3 digital identity solution.

“Once the markets gain more clarity on our product roadmap and realize just how extensive Core DAO’s reach and ambitions truly are, I’m confident we’ll see a resurgence of demand for CORE. Short-term price volatility is par for the course in crypto,” he stated.

The sharp decline in CORE’s price was felt acutely by many retail investors who had piled into the token during last year’s frenzied bull market. Ben Wilkinson, a retail crypto trader from Manchester, U.K., expressed dismay over his struggling CORE investment.

“I got caught up in the hype around CORE last year and went quite overweight. It’s been brutal watching the token just bleed out over the past few months with no relief in sight,” he said. “At this point, I’m just hanging on hoping for some kind of turnaround, but my confidence is really shaken.”

Across all cryptocurrencies, the total market capitalization currently sits at around $1.15 trillion, down over 25% from its November 2023 highs of $1.54 trillion. While down sharply from its peak, the overall market cap still remains up over 70% compared to the same time in 2022 as institutional capital has continued flowing into the space.

Time will tell if CORE is able to mount a recovery or if it will continue languishing as a fallen angel in an increasingly unforgiving and volatile cryptocurrency market.