As we approach the midpoint of the year, Shiba Inu (SHIB), the popular meme coin, appears to be navigating a challenging path. Known for its volatile trading patterns, SHIB is currently displaying bearish signals as it faces both historical trends and present market dynamics, suggesting potential obstacles ahead.

Historical Trends Weigh on Shiba Inu’s Performance

Shiba Inu’s trading history reveals a pattern of significant fluctuations, particularly as the coin moves into the month of May. Despite an extraordinary surge of 355% in May 2021, the subsequent years have not been as favorable, with SHIB experiencing declines of 42.1% in May 2022 and 15.4% in May 2023, according to data from Cryptorank. These trends highlight the unpredictability of meme coins and suggest a tendency towards bearish outcomes in this period, likely influenced by broader market corrections or shifts in investor sentiment.

Current Market Position: Shiba Inu Faces Bearish Sentiment

The present market scenario for Shiba Inu does not offer much solace either. As of the latest trading data, SHIB is priced at $0.0000225, marking a 3.29% decrease over the last 24 hours. The coin’s performance through April was not encouraging, showing a near 24% drop as it transitions into May. This continued downtrend aligns with the broader bearish sentiment affecting the crypto market, partly driven by external macroeconomic factors and specific events within the crypto space, such as Bitcoin halving.

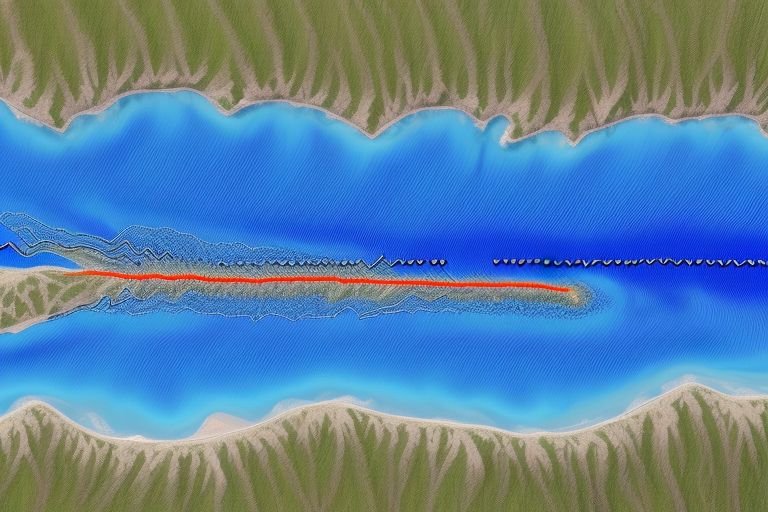

Technical Analysis Indicates Challenges Ahead

Technical indicators for Shiba Inu also point to potential challenges. The coin faces significant resistance at the $0.000026 level. If SHIB manages to break above this resistance, there might be a chance for upward movement towards $0.00003, potentially triggering a more substantial rally. However, resistance at these higher levels is considerable, and any failure to maintain upward momentum could lead to a retest of lower support levels.

The 4-hour chart for SHIB shows that the coin is struggling to maintain momentum above key resistance levels and is consistently challenged by selling pressures at higher price points. The Fibonacci retracement tool indicates SHIB hovering around critical support and resistance zones, with the coin currently testing a major support line at $0.00000225. Should this level fail, SHIB could be looking at further declines, with the next support potentially at the $0.00000200 mark, corresponding to the 0.786 Fibonacci level.

Investor Sentiment and Market Dynamics

The Relative Strength Index (RSI) for SHIB is just above the oversold territory, indicating that selling pressure might be nearing its end, which could potentially lead to a stabilization of prices or a minor bullish correction if buyers re-enter the market. However, the MACD indicator reinforces a bearish outlook, with a continued downward trend in the signal line and an expanding histogram in the negative territory, suggesting that the bearish momentum remains strong.

Looking Ahead for Shiba Inu

Investors in Shiba Inu should remain vigilant and monitor these technical indicators closely. The next few trading sessions could be critical in determining the near-term trajectory of SHIB’s price. With the market showing signs of resistance at higher levels and potential support weakening, SHIB might face more downward pressure before any significant reversal occurs.

As Shiba Inu continues to trade bearishly amid challenging historical trends and negative technical signals, stakeholders and potential investors must approach with caution, prepared for the possible volatility that has come to define the trading dynamics of this well-known meme coin.

+ There are no comments

Add yours