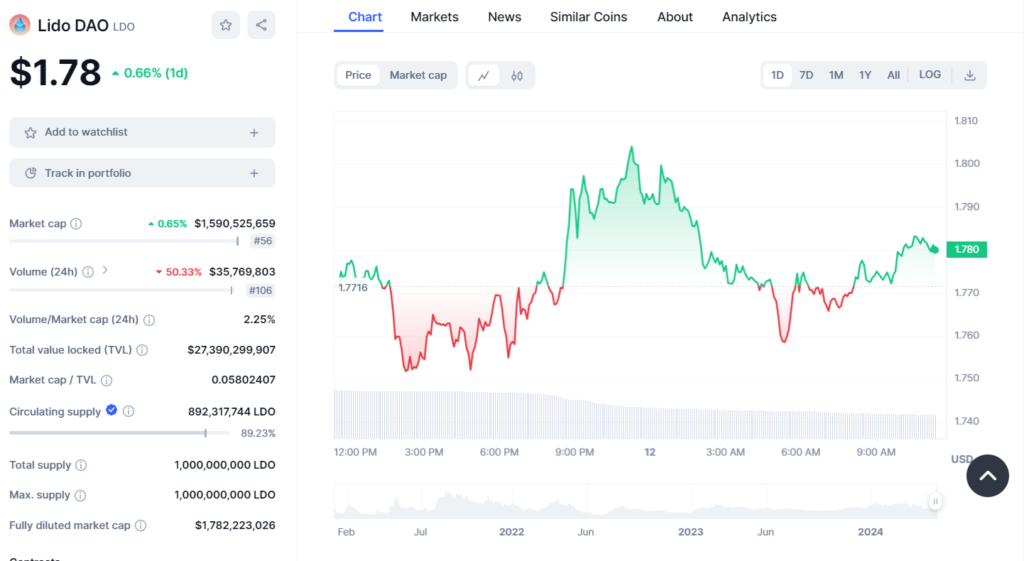

Against the backdrop of the volatile cryptocurrency market, Lido DAO(LDO), a fairly fresh player, is trading sideways and has, however, shown great positive signs on some occasions, reaching $1. 78. Aggregating both perpetual data and market sentiments, one might conclude that Lido DAO’s stable growth path determines a bullish scenario in the upcoming months. This study describes Lido DAO’s price movements and recognizes the main resistance levels.

Today Lido is priced at $1 per token. No. 6 (m) stock had apparently experienced a minimal rise of 0. 75% in the end of the last day. Since a larger time horizon elapsed, the cryptocurrency has recorded stable but fluctuating increases, which are represented in its price and market viscera. The magnitude of Lido DAO stands on the $1 mark. 59 billion ranking it 56th in market capitalization, makes the country’s growing presence in the market more apparent.

Technical Analysis and Market Outlook

Markedly, the price trend of Lido DAO is robust with some technical characteristics showing the trend at this stage. RSI of RSI over 14 day Exponential Moving Average and the Relative Strength Index placed above the mid-line materialize to a positive trend, demonstrating that the momentum is forthcoming for the bulls to claim.

Key Resistance Levels and Potential Upside Targets

Minor Resistance at $1. 75: Lido DAO is confronted with the first formidable obstacle at the $1. 75 mark. Get this task done and move targeting to another resistance level at $1 approx. Through up to 80 in the short run.

Major Resistance at $1. 80: If Lido DAO can reach the $1. Despite the fact that it is close to the psychological level of 80 again, the ICH’s furtherance in that area will likely be faced with some degree of resistance. Such a move can be perceived as a breakthrough in this resistance and a clear way to conquer the psychologically $1 price level. 85 m, this can, in turn, lead to an increase in the reward.

Buying Opportunities and Potential Risks

Positive sentiment notwithstanding, the dynamics of price may forewarn an attractive area where an open position could be taken before further upward movement. The RSI dipping for a slight change could mean that there’s a cooling situation might be prevailing, which at a point could prompt retracement that can form an appropriate entry point for investors.

Key Support Levels and Downside Risks

Breakout Level at $1. 70: The $1. 70 level is a turning point for Lido DAO, as it provides support for the ongoing operations. A lowering of the 5-day EMA below the mark could be seen as reducing the optimism level among the market participants and it could point to a bearish movement of the market.

Strong Support at $1. 65: For instance, when there is a big sway an animal may feel as if it is moving. It is anticipated that the 65 levels will be fully supported, as investors will be very resolute in defending it in order to prevent any further drops.

The limitless structure of Distributed Autonomous Organisation managed to surpass the price setting of $1 even in a volatile cryptocurrency market. The market shall see the resistance of the sellers at the 75 mark and they have the power to make more gains and market resilience. Although the technical indicators are pointing to a bull market, the market participants should still pay close attention to the key levels for the trading opportunities. The resistance at $1. 75 and $1. Lastly and most importantly, the stability of the USD remains a significant factor for the ascendancy of Lido DAO. This condition must be maintained to outperform and overshadow the capitalization of the Dollar above $1. It should come as no surprise that the camaraderie of this very vocal protest will indeed sustain the long-term persistence. With the ever-changing cryptocurrency world, Lido DAO is still a subject of interest for investors who want to explore dynamic and promising digital assets.

+ There are no comments

Add yours