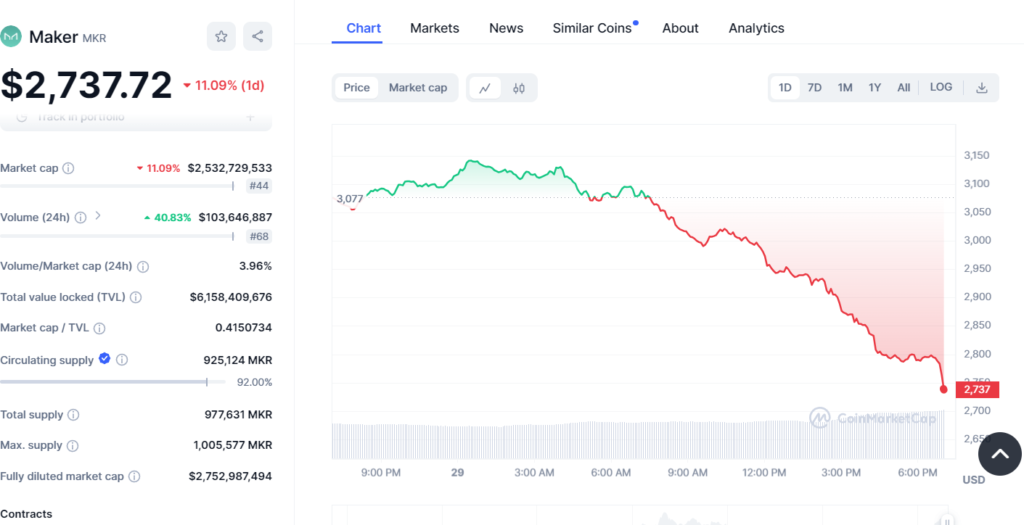

MakerDAO’s governance token MKR witnessed a sharp fall in its price over the past 24 hours, dropping by more than 10% on the back of a wider crypto market slump. By now, MKR is going at $2,752, while it was at $3,100 yesterday.

The deep fall in MKR’s cost is seen as the investors determine the market conditions, and there are still unclear regulations on digital currencies. Bitcoin, the largest cryptocurrency by market capitalization, has also dropped 5% percent in the last day.

“Generally, all cryptocurrencies are being affected because the fear of high inflation and increase in interest rates engulfs central banks,” declared Arlyn Bryant, who is the Head of Digital Asset Strategy at Pythia Capital Management. “MKR is indeed one of the hardest hit among the major tokens because of the complexity of MakerDAO system and promise of DAI stablecoin flow decline.”

In fact, figures from DeFi Pulse reveal that the total value locked (TVL) in MakerDAO’s lending protocol has declined to around $6.16 billion, a figure which is more than 12% lower compared to its February record highs. The fall in the total value of the tokens locked (TVL) is an indicator of the reduced usage of the protocol by the users amidst the market volatility.

On the other hand, some have hope for MKR’s long-term outlook as a result of MakerDAO’s high-profile role in the DeFi (decentralized finance) sphere. undefined

“Personal taste may differ, but people would rather not see double-digit daily drawdowns every now and then. MakerDAO continues being one of the most stable and decentralized crypto lending protocols out there, and I expect demand for DAI and MKR to rebound once the market reaches a new balance”.

The broader crypto market has seen turbulence through the first half of 2024, with the total market capitalization dropping more than 25% from its November 2023 peak, as regulators scan the horizon for crackdowns, and creditors fear market contagion from the failure of several centralized lending platforms.

As a frequent crypto investor and a Dallas dweller, Russell Abrams voiced his concern over the recent market mudslide effects. “It’s become an exhausting roller coaster of prices this year. The absence of regulatory framework is really a burden on the markets and it drives away a lot of retail investors who are like me,” he wailed.

At the moment, MKR occupies the 44th position on the cryptocurrency list with a circulating market cap at the $2.55 billion level and a limited number of tokens up to 1,023,406. Although MKR has slumped significantly this week, it has most likely been up more than 30% for the same time last year.