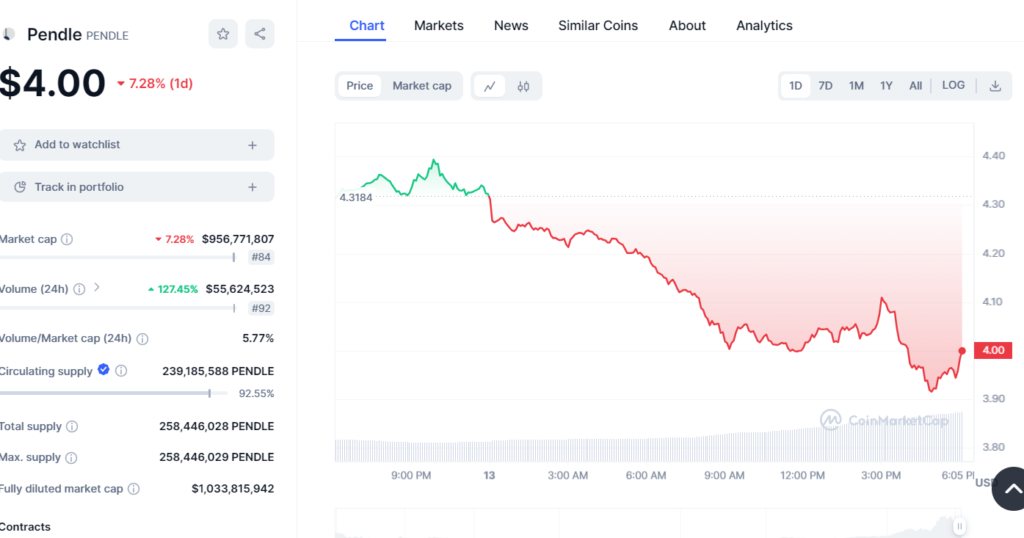

On the 13th of May 2024 – Pendle is a cryptocurrency that has earned the name of the market as well as the participation of the participants. Apart from the variations brought about by these asset exchange rates, this recent price hike has turned the whole industry into its own concert. Pendle, a known player in the DeFi marketplace, slipped big, and the price is at its downtrend, just reaching $4. 00, down by 7. In all, 39% was delivered within a period of 1 day. This not only didn’t give investors the positive image that the creators needed but also made a net of Keno tokens’ life and stability discussions.

To start, Pendle, 84th place in the list of the largest market cap of the cryptocurrencies, rose five times the trading volume. 98%, amounting to $55. 4 million. Despite this Platform being extremely efficient in its role as a trade facilitator, the Coin’s market cap has dropped by about 15 % to $955, as the volumes of Pendle coins in circulation have increased. 6 million. The value of the coin is going to be determined using the volume-to-market-cap ratio which is stands currently at 5. According to the data, there is a 77% chance that this might occur which means the liquidity of the market is high enough and that it could indicate investors becoming nervous and therefore selling their assets for fear of future drop in the market prices.

To see the consequences of a meltdown, we made two surveys: these two attitudes are different: one for the professionals and the other for the average investors. Dr. Emily Stanton, a financial analyst at CryptoMarketWatch, commented on the situation: “The slugs in the Pendle price might be explained thanks to several factors, the macro economical pressures kind of changes in investors’ strategy in the DeFi sector and with the specific ecosystem problems. “Nevertheless, these performances should be an expected norm even in the decentralized finance world and sometimes these dips may as well turn out to be trade opportunities to the long-term investors.

On earth, the public opinion among retail investors is divided. John Doe, an avid crypto investor, shared his perspective: At times the market may be tainted with velocities so that you are simply left confused which I why one wonders “whether your nerves are not so strong”. My knowledge makes such a trick. I can only get to observe the prices, but the strength to hold on to something takes guts. I have a belief that Pendle company will be able to cope with the situation and that I am ready to increase my stake if the company manages to keep the prices at this lower level.

This was the main achievement of Pendle: the ability to trade Ethereum’s future yield on the Ethereum network itself. It is based on the second low oracle protocol. It gives way to investors being able to yield the income of asset holding now and to keep on making the profit of the income through trading it in the secondary market. The application of this system has caused a tidal wave of investors who are all trying to get a piece of the action and the profits.

As a matter of conflict statistics, the local market dynamics have been evidently memorable and influential. However, the overall lay is of about 239, while circulating supply excludes coins or tokens that are either in exchanges, not consumed in the network, or not publicly available. 800 million tokens, which is a fraction of the whole amount of 258. 4 million, approximately 92. This project reserves 55% of its total supply which has already been released into circulation. The lack of this low common denominator will make the market face the price fluctuations of the coin. Each new batch hitting the market can have an impact on the price.

These would fully dilute market cap equals the value of cryptocurrency product at the present price of these active future cryptocurrency tokens were actually circulated to more than one billion us dollars. By this, we may deduce that despite such a decline the general marking for Pendle still reflects the positive way people look at the whole worth of Pendle.

The ups and downs of the crypto market can be seen through the twists and turns of the Pendle story which tells us about the dangers hidden together with the apparent opportunities of the Defi realm. Investors need to cross-check the claims and frequencies, navigate markets, and go through charts and data trends on their own before they make a decision.

Despite the present uncertainty, the community is still engaging in this space and seeing how events unfold. Even though there are ups and downs in the crypto market, the DeFi module is still in the process of development. Pendle’s tale is a demonstration of how the sector endures adversity. Its durability and creativity are being put in a dilemma in these violent seas. Although the future of Pendle or any other cryptocurrency is still not well determined yet, one should bear in mind the simple fact that the crises, such as stock market instability, are merely the gaps where the virtual currencies will be formed to fit the new economic reality.